Tax credits and health care have recently occupied a prominent place in Georgia politics, thanks to the success of a program that helps rural hospitals. Donors to these Georgia facilities can now get a 100 percent state tax credit for these contributions.

But there’s another potential tax credit that could have a positive impact on health in Georgia by alleviating some of the burden of poverty, according to a new report.

The Earned Income Tax Credit is a federal break for the working poor. Georgia could improve the health of lower-income residents by adopting a state version to go along with the federal one, according to the report from the Georgia Budget and Policy Institute.

The Earned Income Tax Credit helps increase the income of working families with lower wages. The federal credit incentivizes work, climbing as wages increase before ending at higher incomes. About 1 million Georgia households earned this federal credit in 2015, the report said.

The report says 29 states have offered a state version of this credit, to offset state and local taxes. But not Georgia.

A refundable Georgia Work Credit set at 10 percent of the federal credit could cut taxes by a few hundred dollars a year for eligible workers, up to about $630 per family, the report says.

The GBPI report cites research that found states with high earned income tax credits showed improvements in maternal health, infant and child health, and mental health.

The proposal has gained increasing legislative support in Georgia, says Laura Harker, author of the GBPI report. It can allow families “to keep more of their wages, and help lift families out of poverty,’’ she said Thursday. “Bigger families get the bigger credits.”

How about the effects on the state budget? The credit at 10 percent would subtract about $300 million from state revenues, Harker said.

The median income of recipients is $14,118 nationally, according to the Robert Wood Johnson Foundation.

Babies in states with their own earned income tax credits are born with higher average birthweights, especially when the credits are larger and families are allowed to keep the full value even if it exceeds their income tax liability, the report said.

Low birthweight is when a baby is born weighing less than 5 pounds, 8 ounces. Some babies with low birthweight are healthy, even though they’re small. But low birthweight can cause serious health problems for some. Such babies may have trouble eating, gaining weight or fighting off infections. Some develop long-term or even permanent health problems.

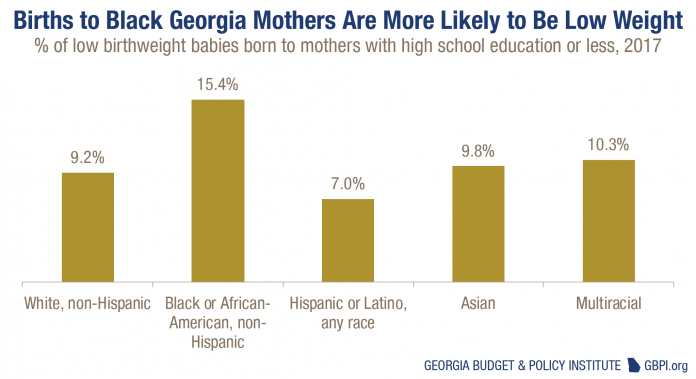

Georgia has the fifth-highest share of newborns with low birthweight in the nation, the GBPI report said.

Low birthweight is a leading cause of infant mortality. Georgia ranks fifth-worst in infant mortality rates.

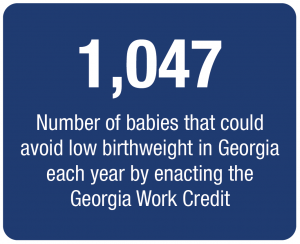

A refundable credit set at 10 percent or greater of the federal credit could result in 1,047 fewer low-weight births in Georgia each year, according to a study led by Emory University researchers.

One of the researchers, Kelli Komro, told GHN that she is “very concerned about the long-term and growing health inequities by economic status and race in the U.S., and in the Southern region of the U.S. in particular.”

Komro cites the March of Dimes giving Southern states D’s and F’s on its Premature Birth Report Card. “Since economic status is linked with poor birth outcomes, we wanted to investigate if policies designed to enhance family economic security would have beneficial effects on birth outcomes,’’ she said..

Babies in states that passed the most generous tax credit laws benefited the most, Komro said. “We also found that the tiniest babies benefited the most.”

The GBPI report also said mothers who received the credit had fewer markers of high blood pressure, high cholesterol and inflammation. Higher tax credits also increased the likelihood that mothers received prenatal care, especially among black women and mothers with fewer years of education.

Higher tax credits are associated with improved mental health among mothers and children, the report said. Mothers with two or more children who receive an increased tax credit refund reported fewer bad mental health days. Children show fewer behavioral health problems, including anxiety and depression, for every $1,000 in tax credit their family receives.

About 23 percent of Georgia children lived below the poverty line in 2016.

Nearly two in three Georgians support a Georgia work credit, according to a July survey commissioned by GBPI.

Elise Blasingame, executive director of the advocacy group Healthy Mothers, Healthy Babies Coalition of Georgia, said this week about the study that “it makes perfect sense that an additional earned tax credit for low-income families will improve maternal and infant health. For one, Mom has more resources in order to make ends meet, pay for medical care, travel to providers in a rural area, etc.’’

“Acute stressors such as financial instability have been linked to risk of poor birth outcomes including preterm delivery, aggravated hypertension, and maternal depressive disorders,’’ Blasingame said. “A reduced tax bill or a refund, however small, has the potential for a very large impact for struggling Georgians.”