One House bill would make Georgia’s Medicaid managed care insurers face stricter requirements on how they spend their government dollars.

There’s a second bill that has also captured their attention – an attempt to wrest control of patients’ prescription drugs from those health plans.

House Bill 1351 would remove the function of the three managed care companies — Peach State, Amerigroup and CareSource — to oversee the dispensing of medication, instead placing it under state supervision. The goal of the bill is to improve care for patients and save the state money, said its lead sponsor, Rep. David Knight, a Griffin Republican.

The bill was approved unanimously this week by the House Special Committee on Access to Quality Health Care. The legislation now goes to the House Rules Committee.

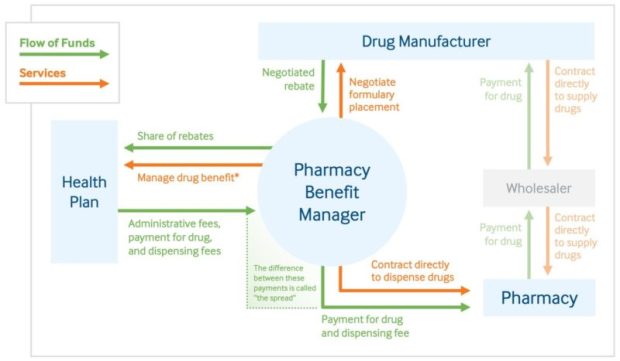

The three managed care companies, which oversee the care of more than 1 million Medicaid members in Georgia, use what are called pharmacy benefit managers, or PBMs. These entities basically serve as middlemen between health insurers or large employers and drugmakers in handling pharmaceutical benefits.

These benefit management groups make decisions on which medications will be placed on an insurer’s list of covered drugs, and how much the insurer will pay for them.

Knight has been a dogged critic of PBMs. He told lawmakers on the health care panel Wednesday that people with cancer or HIV, and chronically ill patients, are being steered to distant PBM pharmacies instead of to local drugstores, many of which are in underserved areas.

Stephanie Wells, a Stage 4 cancer patient, said she is battling with a PBM for better access to her chemotherapy medication. She told lawmakers via Zoom that she has had problems getting her cancer drug delivered. Wells said she would greatly prefer getting the medication locally.

“I’m a very stubborn person, so I will continue to battle them,’’ she said.

Despite state laws against some PBM practices, Knight said, “the games persist.”

Each year, Georgia pays CareSource, Peach State and Amerigroup a total of more than $4 billion to run the federal-state health insurance program for low-income residents and people with disabilities.

The Georgia Pharmacy Association backs the “carve-out” proposal, saying the current set-up jeopardizes independent drugstores.

Phillip Howell, owner of a drugstore in Calhoun, told the House panel Wednesday that his pharmacy has lost more than $100,000 in each of the past five years, mainly because of low payments on the Medicaid prescriptions he fills.

Howell cited a recent case in which he filled an EpiPen prescription for a child. It cost him $300. The managed care company paid him $207 but then charged him a retroactive fee of $150, he said. So he wound up receiving a total of about $57 in reimbursement, taking a big loss.

“I’m on the verge of going out of business,” he told lawmakers.

According to a consulting firm’s study, Knight said, the most likely scenario under a drug carve-out would save the Georgia Medicaid program $3.9 million.

Jesse Weathington, executive director of the Georgia Quality Healthcare Association, which represents the Medicaid insurers, said he doubts that a switch in the drug program will save the state money.

Pharmacy dispensing fees will rise dramatically if the prescription drug benefit is carved out of the health plans, said Weathington, whose group opposes the legislation.

Such a carve-out has already occurred in California’s Medicaid program, called Medi-Cal.

Leanne Gassaway, vice president of state government affairs at CVS Health, which has a PBM that serves Peach State, said in a statement that House Bill 1351 “would force Georgia’s Medicaid beneficiaries into an inferior pharmacy benefit and leave taxpayers on the hook for hundreds of millions of dollars in avoidable health care costs. “

“California’s shift to fee-for-service has disrupted care for millions of beneficiaries and jeopardized timely access to needed drugs” Gassaway said.

Georgia, she added, “should reject a scheme that will only hurt patients and lead to higher prescription drug costs.”

In his presentation to the committee, Knight noted that Centene, the parent company of Peach State, has reached multimillion-dollar settlements in Ohio, Mississippi and other states over lawsuits alleging the company overcharged the states’ Medicaid programs for pharmacy services.

Meanwhile, the three managed care insurers are also confronting medical spending requirements in provisions contained in a proposed mental health parity bill. The high-profile House Bill 1013 would set up a minimum level of medical spending of at least 85 percent of the dollars that Medicaid insurers receive from the program.

GHN and Kaiser Health News reported in September that Georgia is one of only a few states that don’t mandate a minimum level of medical spending and quality improvements for Medicaid insurers.

Weathington told GHN recently that the insurers won’t oppose the 85 percent threshold.

Another House proposal would require more public disclosure about Georgia health plans that serve Medicaid patients, state employees and teachers.

House Bill 1276, if it becomes law, would require the main state health agency to post reports showing how many primary care providers an insurance plan offers in a specific county, along with data on the insurer’s hospital costs and prescription drug spending.

The main sponsor of the proposal, Rep. Lee Hawkins (R-Gainesville), said Weathington had agreed to the bill’s provisions.